In our 27-year history as a Chamber of Business, the latest range of risk insurance instruments is a major leap forward for Canadian institutional investors and African countries - standing to unlock billions in investment capital.

ATI’s African Member states contribute, along with international governments, multilaterals and the private sector, to the pool of capital underwriting investments, without holding any influence over ATI operations. The Nairobi-based multilateral is rated "A/stable" by S&P, and "A3/Stable" by Moody's.

'It has become increasingly clear that to achieve “the Africa we want” the role of private sector must become central in mobilizing the needed resources. Alliances like this one present excellent opportunities to address the development challenges facing our region.'

- Manuel Moses, Chief Executive Officer, ATI

‘During my career on Bay Street, it was clear solutions were needed to unlock the billions of investable capital in Canada. ATI has since developed a suite of products that in my view has dramatically changed the landscape in recent years’

– Deepak Dave, Chief Risk Officer, ATI

‘ATI is a game-changer. From discussions with private equity and pension fund representatives, it is clear that ATI has the potential to ensure both the perceived and real risks on the continent are well-managed; ensuring investment committees can proceed on deals that until recently may have been deemed too risky’

– Sebastian Spio-Garbrah, Chair of the Board

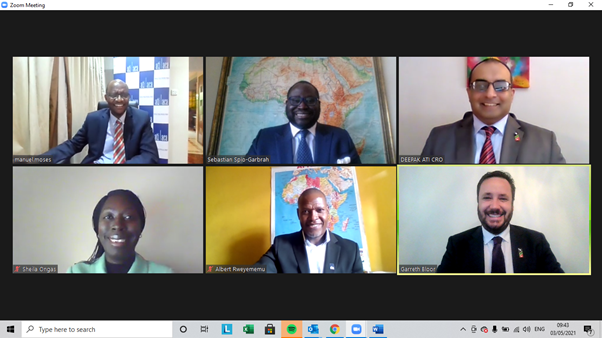

Above (top row): Manuel Moses (Chief Executive Officer, ATI); Sebastian Spio-Garbrah (Chair, The Canada-Africa Chamber of Business); Mr. Deepak Dave (Chief Risk Officer, ATI);

Second Row: Sheila Ongas (Communications Officer, ATI); Albert Rweyemamu (Senior Political & Credit Risk Underwriter, ATI); and Garreth Bloor (President, The Canada-Africa Chamber of Business)

About ATI

ATI has a good market position in Africa, based on the scale of its underwriting penetration and benefits from significant local expertise and understanding in a number of African countries. It currently insures trade and investments worth over USD6 billion or an average of 1-2% of GDP annually in its African member countries. ATI’s partners and clients include African Governments, lenders, traders (both domestic & international) and project developers .